Dental Insurance Informational Page

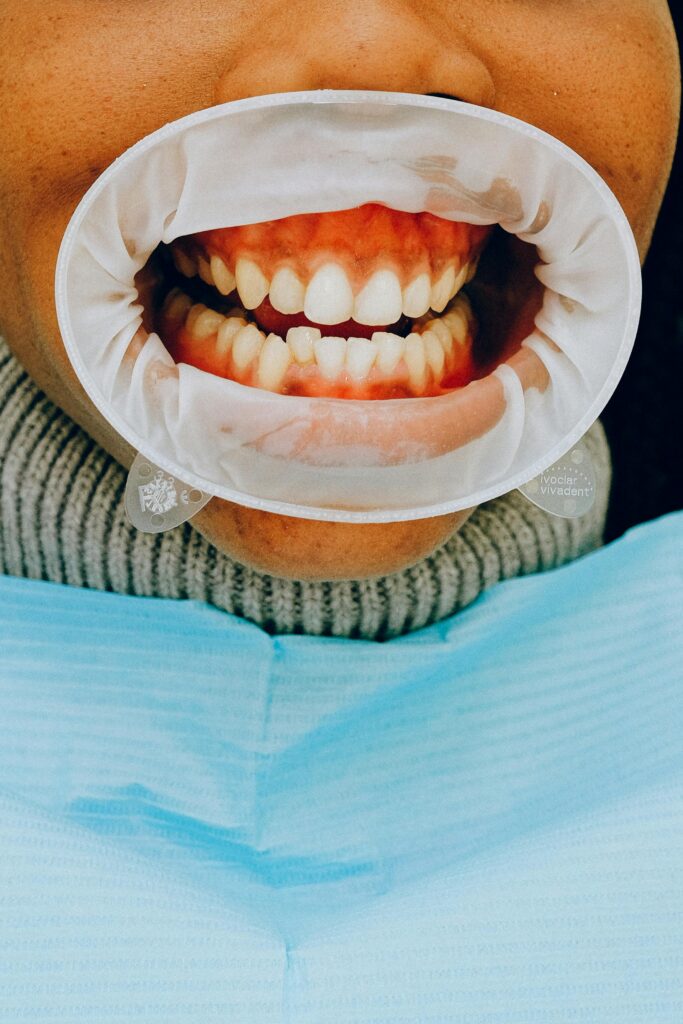

Dental insurance is a type of health coverage specifically designed to help individuals and families manage the costs associated with oral care. It covers a portion of expenses for preventive services like cleanings and exams, as well as basic and major procedures such as fillings, extractions, root canals, and crowns.

Why Dental Coverage Matters

Oral health is closely linked to overall health. Untreated dental issues can lead to serious health problems such as infections, heart disease, and diabetes complications. Having dental insurance encourages regular check-ups, early detection of problems, and affordable access to necessary treatments before they become more severe, and more expensive.

Who Needs Dental Insurance

Dental insurance is beneficial for individuals, families, and employers looking to offer additional benefits to their teams. It’s especially valuable for people who expect to need ongoing dental care or have dependents, such as children, who require orthodontic or pediatric dental services.

What's Typically Covered?

Most group health insurance plans cover a broad range of medical services, including doctor visits, hospital stays, surgeries, prescriptions, preventive care, maternity, and mental health services. Some plans also include dental and vision coverage or offer these benefits as optional add-ons. Preventive services like annual physicals and screenings are often fully covered.

Is dental insurance worth it?

For most people, dental insurance pays for itself through preventive care alone. Regular check-ups and cleanings reduce the risk of costly future treatments, while having coverage helps you budget for both expected and unexpected dental needs. If you value long-term health, dental insurance is a smart, low-cost addition to your overall healthcare plan.

Types of Dental Plans

There are several types of dental plans available, each with different levels of flexibility and cost:

PPO (Preferred Provider Organization): Offers a network of dentists with discounted rates, plus partial out-of-network coverage.

DHMO (Dental Health Maintenance Organization): Lower premiums with in-network-only care and limited provider choice.

Indemnity Plans: Reimbursement-style plans that allow you to see any dentist, typically with higher costs.

What's Typically Covered

Most dental insurance plans categorize services into three levels:

Preventive care (usually covered at 100%): Exams, cleanings, X-rays.

Basic services (often 70–80% covered): Fillings, extractions.

Major services (often 50% covered): Crowns, bridges, dentures.

Some plans may also offer orthodontic benefits, especially for children, though often with waiting periods or coverage caps.

Costs and Premiums

Dental insurance plans are generally affordable, with premiums ranging from $15–$50 per month depending on the coverage level and number of people insured. While the premiums are relatively low, be aware of annual maximums, which cap the total amount the insurer will pay each year, typically between $1,000 and $2,000. Many dental plans have waiting periods for certain services, especially major procedures and orthodontics. For example, while preventive care may be available immediately, fillings or crowns may have a 6–12 month wait. Reviewing these terms in advance helps avoid surprises when you need care.

Disclaimer: North American Mutual is not a licensed health insurance provider and does not directly offer or sell health insurance products. All health insurance-related inquiries, including but not limited to individual medical plans, group benefits, dental, vision, or supplemental health policies, are brokered out to one or more third-party licensed insurance professionals or agencies.

By submitting your information on this site in relation to health insurance, you acknowledge and agree that your details — including your name, contact information, and any specifics regarding coverage interests — may be shared with a licensed third-party agent for the purpose of providing you with additional information, quotes, or policy options.

North American Mutual does not guarantee coverage, pricing, or underwriting decisions made by these third parties. We do not retain binding authority, nor do we participate in the sale, servicing, or management of any health insurance policy issued through these external brokers.

This arrangement applies exclusively to health insurance inquiries. All other lines of business, including life, property and casualty, and personal insurance products, are handled directly by North American Mutual or its affiliated producers.